Medicare Non-covered Services

There are two main categories of services which a physician may not be paid by Medicare:

- Services not deemed medically reasonable and necessary

- Non-covered services

In some instances, Medicare rules allow a physician to bill the patient for services in these categories. Understanding these rules and how to use them in your practice increases the likelihood of getting paid for the services your patients need, even if Medicare doesn’t cover them.

Other categories of services Medicare does not pay include bundled services and services for which another entity, such as workers’ compensation, are primarily responsible (often referred to as “coordination of benefits”).

Medically Reasonable and Necessary

A patient may ask for a service that Medicare does not consider medically reasonable and necessary under the circumstances. For instance, the patient wants the service more frequently than Medicare allows or for a diagnosis that Medicare does not cover. You can often verify coverage information by researching the service on the payer’s website. If the patient’s policy coverage is unclear, inform the patient that it may result in an out-of-pocket expense before performing the service.

There are two resources to help you determine if Medicare considers services to be medically reasonable and necessary: national coverage determinations (NCDs) and local coverage determinations (LCDs). These documents provide information regarding CPT and Healthcare Common Procedure Coding System (HCPCS) codes, ICD-10 codes, billing information, as well as service delivery requirements.

The Centers for Medicare & Medicaid Services (CMS) offers an online, searchable Medicare Coverage Database that allows anyone to freely search NCDs, LCDs, and other Medicare coverage documents. The database has quick and advanced search capabilities to search by geography, Medicare contractor, key words, CPT codes, HCPCS codes, and ICD-10 codes.

Commercial insurance companies and some Medicaid payers will have similar types of information about their coverage guidelines on their websites. Stay up-to-date on these policies for your local payers to ensure claims are processed as medically reasonable and necessary.

Inform Patient of Potential Financial Responsibility

In all cases, if the patient’s policy coverage is unclear, inform the patient that they may be responsible for paying for the service. This should be done before you provide the service.

If a Medicare patient wishes to receive services that may not be considered medically reasonable and necessary, or you feel Medicare may deny the service for another reason, you should obtain the patient’s signature on an Advance Beneficiary Notice (ABN). Medicare requires an ABN be signed by the patient prior to beginning the procedure before you can bill the patient for a service Medicare denies as investigational or not medically necessary. Otherwise, Medicare assumes the patient did not know and prohibits the patient from being liable for the service.

You must explain the ABN to the patient and the patient must sign it before the service is provided. The ABN must have the following three components:

- Detailed description of the service to be provided;

- Estimated cost within $100; and

- Reason it is believed Medicare will not cover the service.

If an ABN is obtained, attach modifier -GA (waiver of liability statement issued as required by payer policy, individual case) to the line item(s) within the claim to indicate the patient has been notified.

The CMS website has additional information and downloadable ABNs in several formats.

Non-covered Services

Certain services are never considered for payment by Medicare. These include preventive examinations represented by CPT codes 99381-99397. Medicare only covers three immunizations (influenza, pneumonia, and hepatitis B) as prophylactic physician services.

Cosmetic procedures are never covered unless there is a medically-necessary reason for a procedure. In this instance, you should document and code it as such. Services rendered to immediate relatives and members of the household are not eligible for payment.

Non-covered services do not require an ABN since the services are never covered under Medicare. While not required, the ABN provides an opportunity to communicate with the patient that Medicare does not cover the service and the patient will be responsible for paying for the service. Pre-emptive communication through a voluntary ABN can prevent negative patient perceptions of your practice and facilitate collections. These modifiers are not required by Medicare, but do allow for clean claims processing and billing to the patient. There are three modifiers to consider when dealing with non-covered services:

- -GX – Notice of liability issued, voluntary payer policy. A -GX modifier should be attached to the line item that is considered an excluded, non-covered service. The -GX modifier indicates you provided the notice to the beneficiary that the service was voluntary and likely not a covered service.

- -GY – Item or service statutorily excluded, does not meet the definition of any Medicare benefit or for non-Medicare insurers, and is not a contract benefit. If you do not provide the beneficiary with notice that the services are excluded from coverage, you should append modifier -GY to the line item. Modifier -GY indicates a notice of liability (ABN) was not provided to the beneficiary.

- -GZ – Item or service expected to be denied as not reasonable and necessary. Modifier -GZ should be added to the claim line when it is determined an ABN should have been obtained, but was not.

Utilizing ABNs and corresponding modifiers appropriately assists with compliance reporting in your office.

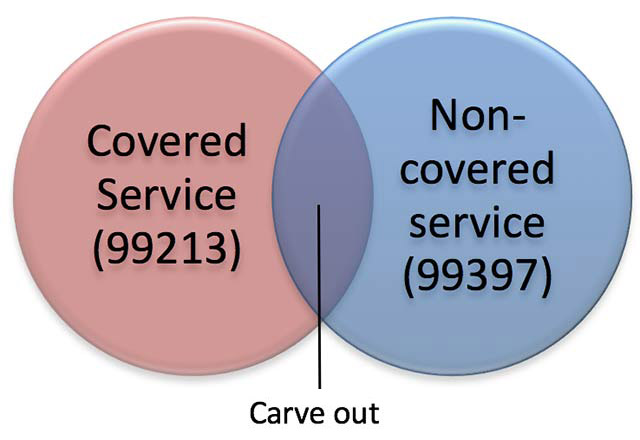

Medicare Carve-out Services

It is important to code all services provided, even if you think Medicare will not cover the services. Medicare has strict rules when billing for covered and non-covered services on the same date. This is often referred to as the “carve-out rule.” For instance, in the case of a medically-necessary visit on the same occasion as a preventive medicine visit, you may bill for the non-covered (carved-out) preventive visit, but must subtract your charge for the covered service from your charge for the non-covered service. For example, a problem-oriented visit allows for a history and examination, as does a preventive visit. The “carve out” eliminates the duplicate payment for these elements, paying you for performing the service only one time.

Patients need to be aware of cost-sharing when a problem-oriented visit is billed on the same occasion as a non-covered preventive visit. An ABN is not required, but a conversation with your patient before the services are rendered would be appropriate.

For example, a 67-year-old established patient presents for a covered service, such as an office visit for a chronic illness (e.g., 99213). At the same encounter, the patient chooses to receive a preventive medicine examination (e.g., 99397), which is a non-covered service under Medicare.

| SERVICE | CHARGE AMOUNT |

|---|---|

| 99397- preventive exam (non-covered service) | $201.00 |

| 99213- office visit (covered service) | -$130.00 |

| Patient billable amount for 99397 | $71.00 |

Bundled Services

Medicare and most other payers do not allow for services to be “unbundled” when it has designated a set of services as represented by one payment (bundled). Examples include pre-operative and post-operative care when billing for a surgery or billing for multiple laboratory procedures when a single panel test represents the service performed. When Medicare or another payer designates a service as “bundled,” it does not make separate payment for the pieces of the bundled service and does not permit you to bill the patient for it since the payer considers payment to already be included in payment for another service that it does cover.

Coordination of Benefits

All payers will demand that correct coordination of benefits be followed for claims payment. Medical services are not always the responsibility of a health insurer. Payment may be the responsibility of other entities, such as automobile insurance, workers’ compensation, liability insurance, etc. Likewise, if a patient has multiple health insurance coverage (e.g., Medicare and employer coverage), one health insurer may be primary, and the secondary insurer will not pay until the primary policy has paid. You should verify coordination of benefits in all cases of accident, injury, and when multiple insurance policies are involved.

Reference

Medicare Learning Network (https://www.cms.gov/Outreach-and-Education/Medicare-Learning-Network-MLN/MLNProducts/Downloads/Items-and-Services-Not-Covered-Under-Medicare-Booklet-ICN906765.pdf)