Physicians and other providers will soon have a chance to bypass the middleman and compete in managed Medicare.

Fam Pract Manag. 1998;5(3):34-45

Among physicians, the words “Medicare” and “opportunity” have always been an unlikely combination. Last August, though, the two finally came together in a big way in the “Medicare+Choice” provision of the Balanced Budget Act of 1997. Under Medicare+Choice, physicians, hospitals and allied health professionals now have the unique opportunity to organize provider sponsored organizations (PSOs) and contract directly with the government for Medicare-risk contracts, eliminating the administrative/insurance “middleman.” Through this new type of managed care organization, providers will develop and own the assets and infrastructure of the company and will control all aspects of health care delivery. Ultimately the new PSO legislation may even generate a fundamental shift in the managed care industry and bring providers into the forefront of risk management. (See “The history of PSOs.”)

Family physicians interested in being among the first wave of providers entering this new venture should act quickly but carefully. While many details remain unclear, pending federal regulations to be released this spring, sufficient information about the basic structure and role of PSOs is already known and can help providers lay the necessary groundwork.

The history of PSOs

The concept of provider sponsored organizations (PSOs) emerged in the 1980s, when insurers were increasingly pressuring provider groups to cut health care costs. Competition for prepaid plans in the commercial/ERISA beneficiary market succeeded at controlling costs, but insurers' techniques quickly came under fire, as they were accused of taking undue advantage of providers and their delivery systems. As a result, providers began to create ownership interests, developing their own HMOs in an effort to gain more control. By the late '80s, consumer backlash against HMOs along with the increasing managed care sophistication of provider groups began to drive the development of new delivery systems and new care management techniques.

In 1989 the National Health Policy Council recommended the development of “provider-owned accountable health plans.” Provider groups had become increasingly involved in managing risk and the premium dollar; therefore, it was suggested that providers be allowed to create and own the full risk-managing infrastructure of prepaid health plans. These provider-owned plans could in turn contract directly with employers. This move eliminated the “middleman” and established a greater level of accountability and value between providers and purchasers. The White House developed this concept further in 1993 as part of the Clinton administration's health care policy. In 1995 the president's budget included “provider sponsored network” language and policy for the first time. Congress endorsed the concept and further refined it as a Medicare fund management strategy, redefining the organizations as PSOs and including them in the Medicare+Choice provision of the Balanced Budget Act of 1997.

The future solvency of the Medicare Trust Fund is a critical issue, and the government sees managed care as an essential strategy for controlling Medicare costs and managing its quality of care. Currently, only 12.5 percent of the Medicare population is enrolled in managed care plans, compared to over 70 percent in the commercial marketplace. The government believes that by the year 2002 the number of Medicare risk enrollees can be increased to 20 percent. This transition of Medicare beneficiaries from a fee-for-service system to the many managed care options, including PSOs, has been termed the “ERISA-fication” of Medicare.

What is a PSO?

A PSO is a managed care contracting and delivery organization that accepts full risk for beneficiary lives; that is, the PSO receives a fixed monthly payment to provide care for Medicare beneficiaries. PSOs may be developed as for-profit or not-for-profit entities of which at least 51 percent must be owned and governed by health care providers (physicians, hospitals or allied health professionals). PSOs may be organized as either public or private entities, although this article will primarily address the latter. A PSO must supply all medical services required by Medicare law and must do so primarily through its network. In fact, a PSO's owner-providers must deliver at least 70 percent of the cost of services; the remainder may come from contracts with other providers if necessary.

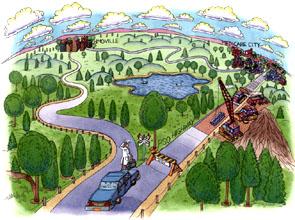

To be in the best position to assume full risk for the full range of Medicare benefits, a PSO must be structured as a tightly integrated delivery system (IDS). Primary care physicians, as the direct link between the risk-bearing entity and patients, are essential to the total risk-management strategy of any IDS, including a PSO. To be legally and financially viable, PSOs will need primary care physicians who can create the access necessary to attract a sufficient number of enrollees. In return, primary care physicians must be able to participate in the risk-management infrastructure and should be owners. “The structure of a PSO: one option” illustrates how physicians and other entities are linked together to create access and deliver care in a PSO IDS.

The structure of a PSO: one option

The diagram below illustrates how physicians might align with other entities to create a provider sponsored organization (PSO), which is in essence a specialized integrated delivery system (IDS). Although nonproviders (vendors) have some ownership in this example, the physicians and hospitals are majority owners. To create the necessary access and provide all services required, the owners of the PSO contract with other physicians, hospitals and vendors as well.

A different set of rules

PSOs are just one of the government's many initiatives designed to control Medicare costs by stimulating the movement of beneficiaries into managed systems of care. PSOs are unique, however, as the only emerging significant stand-alone alternative to “traditional” managed care organizations. They stand apart from other risk-contracting entities in three key ways:

A PSO owns its license, so administrative functions are provided either in-house or through insurance contractors that act as vendors, not owners.

A PSO's majority owners (the providers) are charged with managing the total premium dollar, so it is very likely that physicians will be directly involved in governing the organization and managing the delivery of care.

A PSO is not subject to a state premium tax, while HMOs and other heath plans are.

PSOs also differ significantly from other managed care entities in their licensure and reserve requirements, which in both cases make it easier for providers to develop a company and apply for certification in a timely fashion. While all other Medicare-risk products are federally regulated and certified in compliance with state licensure requirements, PSOs may bypass state licensure in some cases. For example, if a state does not approve a substantially complete application within 90 days, the PSO may apply for a federal waiver. Federal waivers will be valid for up to 36 months but cannot be renewed and will not be issued after Nov. 1, 2002.

In addition, PSOs will not be held to the same state solvency standards as insurers. Although the government is not expected to release PSO solvency standards until April 1, we anticipate that these requirements will be less, and certainly no more, than those for HMO health plans. Of course, the government will insist that PSOs guarantee their services in some fashion. Cash reserves will be required, although the level of reserves is still being debated. The standards adopted will have to evaluate such things as the PSO's assets, its reinsurance policies and the impact partnering would have on the PSO.

Detractors of the PSO strategy are concerned that the government, in its drive to create policy, will inappropriately calculate the real risk of PSOs. Insurers argue that the savings and loan disaster of the 1980s was precipitated by poor solvency legislation and have voiced concern that this may be repeated. They also argue that if PSOs are allowed to accept and manage risk like HMOs, they should be held to the same standards.

But PSOs do not manage risk in the same way HMOs manage risk. A PSO accepts risk by providing all plan services internally, not by contracting them out like HMOs. In essence, HMOs must keep higher reserves to “buy” more provider services in an emergency. PSOs are providers and are legally bound to provide services for free if they are in financial trouble. PSOs, therefore, should have a different measure of solvency than HMOs.

Oh, the possibilities

The business opportunity in Medicare risk is great, in part because the average adjusted per capita cost (AAPCC) reimbursement levels are considerably higher in many regions of the nation than they have been in the past. Under the Medicare+Choice provision, capitation payments will not drop below a national floor of $367 per member per month for 1998. As illustrated in “The business opportunity,” a PSO that administers 17,500 Medicare+Choice beneficiaries could receive $87.5 million in premium revenue in one year for those lives. And if the PSO manages itself and its patient care activities efficiently, performance improvements over time could generate a savings estimated at over $19 million. The key is the PSO's ability to manage its revenue (or risk) appropriately while maintaining high-quality care.

Opponents of the new legislation believe for a number of reasons that PSOs will not be able to manage this risk. In particular, they see an inherent conflict of interest between the providers' desires to maximize their compensation (and earnings from the plan) and the PSO's need to be competitive in the marketplace, achieve cost control and reinvest savings in the total PSO infrastructure. As stated earlier, however, providers argue that, unlike banks or HMOs, they can deliver appropriate services even with little money in their coffers.

The business opportunity

Ptions (PSOs) under the new Medicare+Choice provision face a tremendous business opportunity.

Consider a PSO constructed around a network of 200 physicians: 100 primary care physicians (90 family physicians and internists, 10 pediatricians) and 100 referral specialists. Assume that the family physicians and internists average 2,000 active patients each, 65 percent commercial/ERISA and 35 percent Medicare. A reasonable target population for this PSO would be 70,000 Medicare beneficiaries. This represents $350 million in potential PSO premiums, assuming $5,000 per member per year. If 25 percent of the target population (or 17,500 beneficiaries) enrolled in the PSO product, their premiums would bring in $87,500,000. And while that is certainly adequate to cover the costs of administration and care today, the potential for improvements within most integrated delivery systems makes the premium seem even better, as the table below shows.

| PSO premium: $87,500,000 | ||||

|---|---|---|---|---|

| Expenses | Today | Potential improvements | Potential savings | |

| Administration: 25% of premium | $21,875,000 | 20% decrease | $4,375,000 | |

| Medical loss ratio (MLR): 75% of premium | $65,625,000 | |||

| Hospital/institutional providers | $36,750,000 | 35% decrease | $12,862,500 | |

| Primary care providers | $10,683,750 | |||

| Other specialty care providers | $10,683,750 | 15% decrease | $1,602,562 | |

| Pharmaceutical providers | $4,331,250 | 10% decrease | $433,125 | |

| Ancillary providers | $3,176,250 | |||

| Total potential savings: $19,273,187 | ||||

Matters of accountability

PSOs will be accountable to HCFA for the quality of their services and the financial solvency of their plans. If a PSO does not meet these requirements on an ongoing basis, HCFA will cancel its contract. PSOs, whether licensed at the state level or operating under a federal waiver of state licensure, must abide by the state's beneficiary protection standards. PSOs also have statutory characteristics that differentiate them from traditional state-licensed managed care plans.

Although PSOs must meet federal standards for quality and performance, the state will also be charged by the secretary of Health and Human Services (HHS) with monitoring their quality and performance based on state standards.

The 50/50 rule that required Medicare managed care plans to have one commercial life for every Medicare life enrolled is not applicable to PSOs. PSOs will need to meet minimum enrollee requirements (1,500 Medicare enrollees in urban areas; 500 in rural areas), but the HHS secretary may waive the requirement altogether during the first three years of a PSO's contract. The waiver must be requested in the application process. This means a PSO may not have to enter into the commercial market as well as the Medicare market.

HCFA will audit the finances and quality records of the PSO annually.

While PSOs are not subject to a state premium tax, a federal fee similar to a premium tax will be required.

PSOs that are unable to meet the statutory requirements and fail to pass HCFA's annual audit of their operations may be shut down and fined. Statutory sanctions, in particular, may be imposed on any Medicare+Choice organization that fails to provide medically necessary items and services, imposes premiums on Medicare+Choice enrollees, discourages the enrollment of beneficiaries with pre-existing conditions or fails to comply with other Medicare requirements.

What's next?

For physicians interested in the PSO concept, time is of the essence. HCFA is anticipating that 200 to 800 PSO applications will be submitted in the next 12 to 18 months, with beneficiary enrollment set to begin in January 1999. Early market entrants will have the advantage in securing market share and in capturing partners that can help create the necessary continuum of care and help with plan administration.

Clearly, family physicians will be essential to PSO networks and should start evaluating what the real market opportunities are. Whether a group elects to design and implement a new PSO or chooses to develop the internal functional capabilities to align with an existing PSO, there are a number of operational and organizational issues to consider. To identify the best options, groups will need to undertake four key analytical tasks, either internally or with the assistance of consultants familiar with PSOs and Medicare-risk requirements:

Assess the potential enrollee population. One way to do this is by creating a demographic profile of the Medicare population: who they are, where they are and how they receive care now.

Analyze the delivery needs. A PSO must deliver all medical services required under Medicare, primarily through its own providers. Specify what these services might be, and identify the providers necessary to deliver these services.

Identify potential development partners. Look for provider organizations that could help develop the care continuum as well as for support organizations that could help administer the health plan. For physicians, hospitals are a logical key partner because not only can they help meet the delivery requirement, but they also offer development capital and asset management expertise.

Review all internal management processes. Examine all medical and practice management programs now used by member physicians. All participating providers must be prepared to handle significant risk.

The medical management of the PSO must emphasize prevention and total patient care management. A PSO's success in assuming and managing risk will depend in large part on its key business functions, including an effective marketing plan, grievance and appeals processes, administrative support systems and utilization management processes. To be competitive, PSOs will probably need to deliver pharmacy services and “Medigap” benefits as well, allowing beneficiaries to have a single health plan. The PSO may choose to charge a premium for these services and may also utilize a system of co-payments. These and other issues must be addressed in the early stages of a PSO's development.

A fundamental change

The new Medicare+Choice legislation with its PSO initiative is expected to create a fundamental change in health care delivery. Providers who enter the PSO market now will have the opportunity to work actively with the government to shape the new organizations and the policy being developed to support them. In the 1970s, the HMO industry had a similar opportunity, which unfortunately has resulted in costly administrative processes and financial systems that have little to do with providers or the care they deliver. Now, by assuming the risk of administering health plans to Medicare beneficiaries, physicians and other providers have the tremendous opportunity to change the fundamental nature of the industry.

Editor's note: Family Practice Management will report further developments related to PSO development as the anticipated guidelines are released this spring.